Tsp installment payment calculator

Installment payments are available on a monthly most popular quarterly or annual basis. The regular 10 early.

2022 Cola Announced And Annuity Projection Calculator

The TSP can also transfer all or part of any single payment or in some cases a series of monthly payments to a traditional IRA or eligible employer plan.

. As of September 15 2019 you now have more options for how and when you can access money from your TSP account. Deferrals can be for up to 180 days in a 365 day period or for the duration of the Service members active duty plus 60 calendar days whichever is less. There is a 150 fee to register.

Thus an exemption is allowed for distributions from defined contribution plans or other types of governmental plans such as the TSP. See IRC Section 72t10 as amended by the Defending Public Safety Employees Retirement Act PL. With installment payments your money will remain invested in the TSP where it will hopefully continue.

Compare auto loan rates and discover how to save money on your next auto purchase or refinance. Saving money on interest costs by lowering your monthly payment and or the term number of years you pay the loan Getting rid of an adjustable-rate loan which have less stable monthly payments. Retail installment contracts.

Property taxes on the Service members primary residence. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees. The following COVID information was for 2020 Returns.

This means that in order to transfer your entire payment you must use other funds to make up the 20 withheld. 1137 Projects 1137 incoming 1137 knowledgeable 1137 meanings 1137 σ 1136 demonstrations 1136 escaped 1136 notification 1136 FAIR 1136 Hmm 1136 CrossRef 1135 arrange 1135 LP 1135 forty 1135 suburban 1135 GW 1135 herein 1135 intriguing 1134 Move 1134 Reynolds 1134 positioned 1134 didnt 1134 int 1133 Chamber 1133 termination 1133 overlapping 1132. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve.

Also the restriction that only defined benefit plans qualify for the exemption is eliminated. Get expert advice on auto loans. The TSP is required to withhold 20 of your payment for federal income taxes.

Learn more about the California Military Families Financial. As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. Any person or entity who will be responsible for the payment of a surcharge on more than one trip in any calendar month must register with the New York State Tax Department by completing an online application and obtaining a certificate of registration which will be valid for the specified term on the certificate and is subject to renewal.

If you do not roll over the entire amount of your payment the non-transferrable portion will be taxed. Can I withdraw money from my TSP without penalty.

Tsp Archives Military Financial Advisors Association

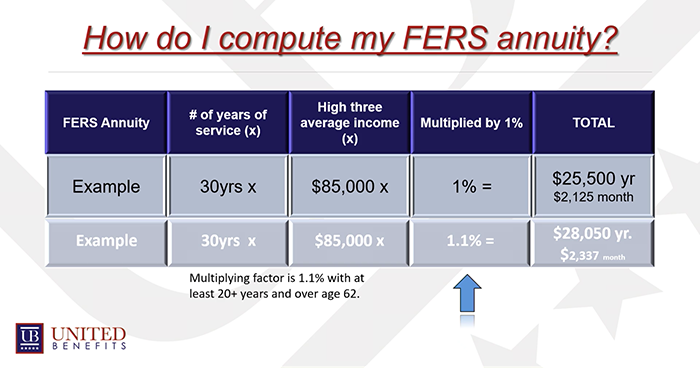

What Is The Fers Annuity And How Do I Compute Mine United Benefits

2

Unionpay International Developer

2

Tsp Archives Military Financial Advisors Association

2

Many Patients Travel To Cny Fertility

2022 Cola Announced And Annuity Projection Calculator

Tsp Choices Monthly Payments Vs A Life Annuity

2

2

Tsp 81 Form

2

2022 Cola Announced And Annuity Projection Calculator

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

Home Loan Interest Vs Principal Instacalc Online Calculator